California Cannabis Industry Owes State A Quarter Billion Dollars In Taxes

Collection efforts appear to be ramping up

With penalties and fees, the money owed to the state could top $500 million.

The California cannabis industry as a whole owes the state a quarter billion in unpaid taxes, according to state data and industry experts. With added fees, that total could easily balloon into a $500 million tax tab.

To combat the rising debt trend, collections efforts appear to be ramping up, even against companies that have gone out of business.

As of Dec. 2, the cannabis sector as a whole was carrying $250,410,890 in unpaid sales and cannabis taxes, out of a $4.4 billion total in taxes due, according to data from the California Department of Tax and Fee Administration (CDTFA).

But the amount due from cannabis operators could easily double when penalties and interest are tacked on, said tax attorney Regina Unegovsky.

Tax Debts Mounting

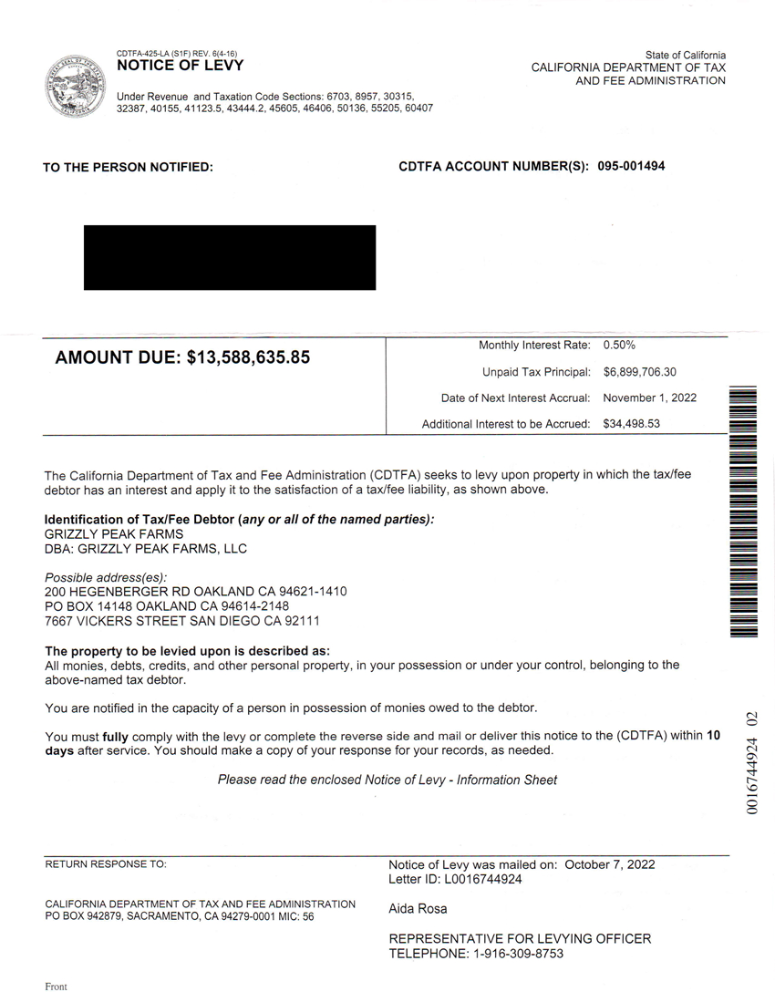

Unegovsky cited an October lien letter from the CDTFA to a Los Angeles retailer, obtained by Green Market Report, that shows San Francisco Bay area cultivator Grizzly Peak owes the state $13.5 million, even though the principal tax balance only totaled $6.8 million.

To Read The Rest Of This Article On Green Market Report, Click Here