Cannabis Startups 101 – Get Your Business Advice Here

A collection of knowledge from industry insiders

Our cannabis attorneys see many cannabis deals and on a daily basis we see term sheets, pitch decks, prospectuses, fund summaries, etc. Though we’re always on the legal side, we are also often asked for advice we’d label “business advice” — ranging from the specific (here’s our deck, what valuation can we demand?) to the very general (as investors where should we put our money ahead of what’s going to happen with California cannabis in 2018?). In this post I offer our thoughts on some common issues.

Company Founders Ask: What are Investors Looking for?

If you spend too much time and thought reworking the numbers on a term sheet, or even believing those numbers play a big role in driving investor interest, you’ve got it wrong. I for one have never heard an investor say “the product misses the mark and the team is mediocre, but with these investment terms I’d be crazy not to jump in!” Though Shark Tank isn’t what life is really like out in the trenches, it does get the investment decision process in the right order: first the sharks meet the team and get their pitch, then they discuss and negotiate numbers.” If you’re too focused on the numerical terms, you’re better off not having a term sheet — a pitch deck (or even a one-pager) that focuses on the following is much more likely to drive an investor discussion forward:

- the size of the opportunity

- capturing the imagination of the investor

- selling the investor on the team – the people – as the right ones to execute and seize the opportunity

Investors Ask: Where are the Big Returns?

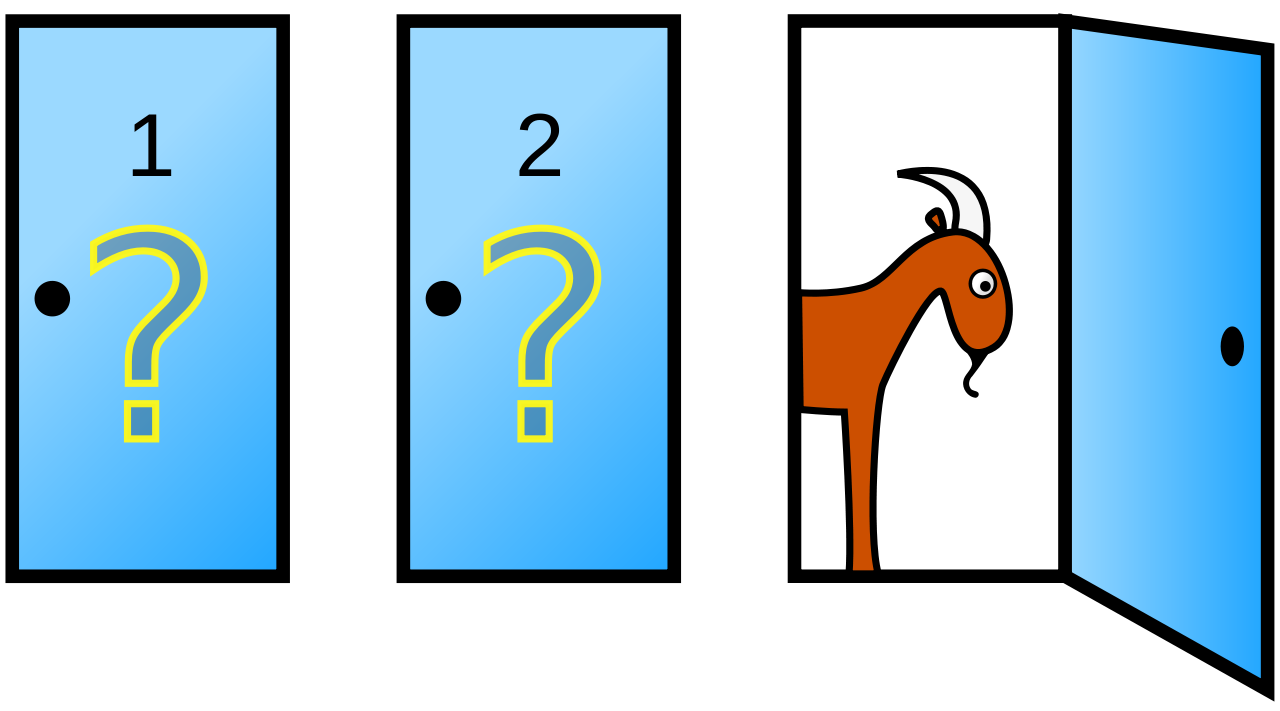

Many investors assume higher risk companies will mean higher returns. And with this assumption often comes another one: companies that “touch the [cannabis] plant” (and are therefore unsuitable for nearly all institutional capital) will generate the highest returns. For investors using debt instruments and looking purely at interest rates as their ROI, this may be true. But for equity investors, it’s all about scale, and companies whose primary business is one that “touches the plant” rarely have the highest scalability. Though there aren’t nearly enough company exits to say for sure, the big returns are far more likely to be found in business-to-business ancillary cannabis companies – software, data metrics, equipment leasing, and other business services.

To Read The Rest Of This Article On Canna Law Blog, Click Here.