With the stroke of a pen under a brown EPA seal, Administrator Scott Pruitt took a definitive stance on the agency’s view on marijuana.

The Environmental Protection Agency will deny any requests to license pesticides for cannabis made under a provision that grants states power to approve weedkillers, insecticides, and fungi-controlling chemicals for local uses, Pruitt told four states last month.

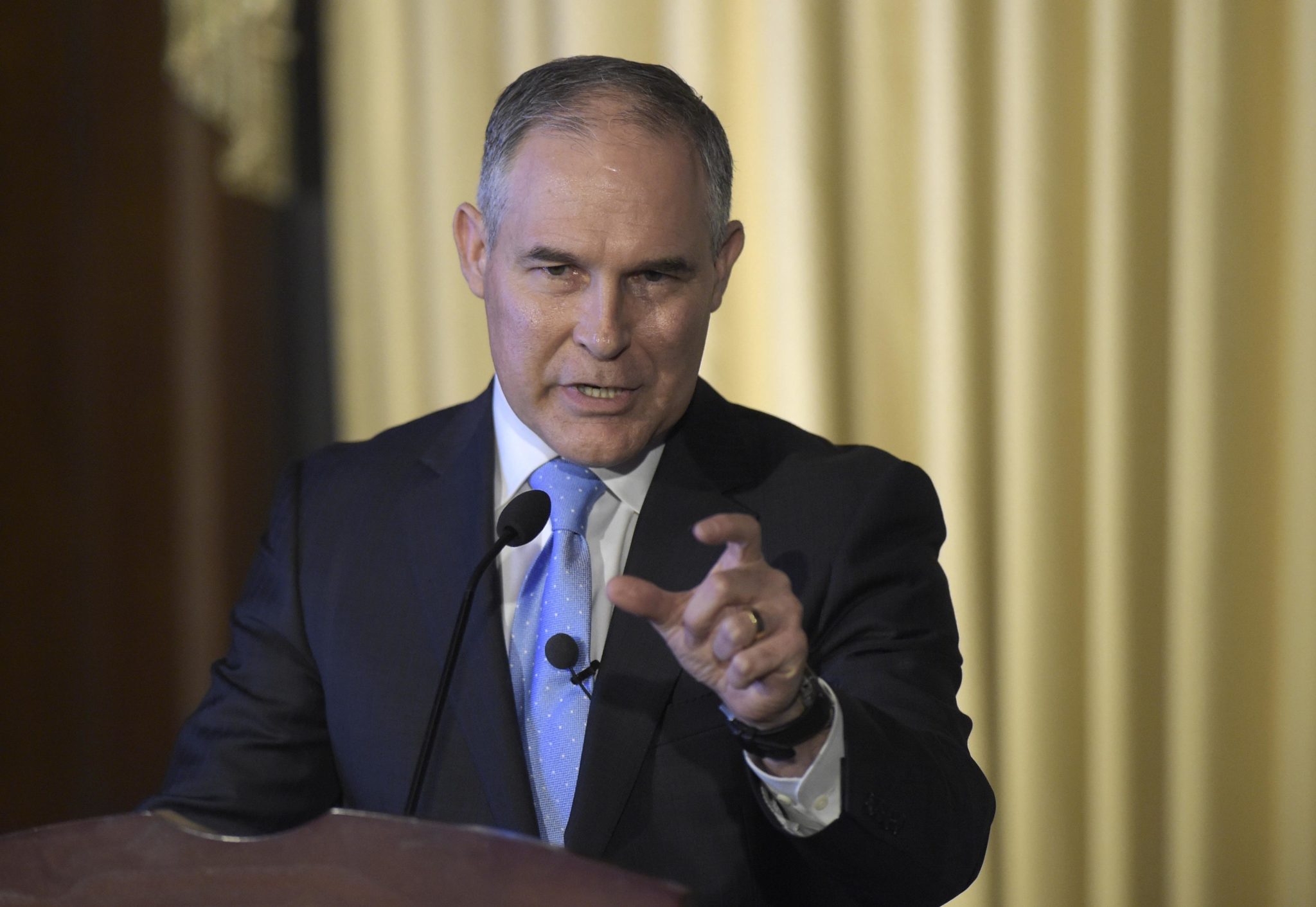

Environmental Protection Agency Administrator Scott Pruitt (Susan Walsh/Associated Press Photo)

California, Washington, Nevada, and Vermont applied to register four pesticides made by General Hydroponics, a Santa Rosa, Calif.–based company owned by a subsidiary of Scotts Miracle-Gro Co. Pest damage is a recurring problem in what’s slated to become a $22.6 billion legal cannabis industry by 2021, and producers are limited in how they can fight them, states, growers, and investors argue. Marijuana growers receive scant guidance on how to apply pesticides effectively or safely, and in some cases resort to products that contaminate it with toxic fume-creating chemicals.

“If we have a pest or pathogen issue, it’s much more difficult to eradicate,” Alex Cooley, one of the founders of the Seattle-based Solstice, which produces marijuana from tens of thousands of plants across Washington state. “We need to be treated like [the rest of] agriculture to appropriately supply the marketplace.”

The reason for the denial, Pruitt said in his June 22 letter, was evident: Marijuana cultivation is banned under federal law, despite being legal in seven states and the District of Columbia and approved for medicinal use in 29 states. Like many decisions Pruitt has taken since heading the agency in February, it was a detour from the path the Obama administration took.

The four pesticides were the first in an attempt to use a provision of the nation’s pesticide labeling law to register uses on cannabis. Under Section 24(c) the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), a state can ask the federal government to hand over pesticide registration responsibilities if the state can demonstrate a “special local need” (SLN) for a specific use.

Bad Situation

Producers, and investors who want to cash in on the lucrative market, are thrown into uncertainty when they lack federal guidance, Hadley Ford co-founder and chief executive officer of iAnthus Capital Holdings, a cannabis finance and investment firm with plant-growing operations in four states, told Bloomberg BNA. Consumers also lack the health protections that the EPA provides through regulation.

“It creates a situation that’s sort of ‘buyer beware,’ ” Ford said.

Under former EPA Administrator Gina McCarthy, the agency sought to let states take the lead on regulating marijuana pesticides with the federal government’s oversight. Former Office of Pesticide Programs Director Jack Housenger sent the Colorado Department of Agriculture a letter in 2015 with guidelines for registering their own pesticides for cannabis.

The EPA receives dozens of special local need requests every year. Missouri recently used it to lift a ban on new formulations of the herbicide dicamba, which was prohibited in three states amid widespread crop damage due to misuse. Some saw the 24 (c) process as the best option to regulate pesticides in the nascent industry.

“I think he’s put them in a bad situation,” Housenger, who retired from the agency shortly before Pruitt’s Senate confirmation, told Bloomberg BNA.

Cannabis growers are not bereft of options. States have compiled lists of relatively low-toxicity and general-use pesticides that are exempt from EPA registration requirements and work with varying degrees of success. These options are limited to oils, vegetable extracts, and other mixes deemed low-risk, but with little data to show they successfully kill pests. Growers also can legally use pesticides that are approved for a broad category like “household plants.”

“We end up with not a lot of options,” Rose Kachadoorian, pesticide registration and certification leader for the Oregon Department of Agriculture, told Bloomberg BNA.

Reaching Out in Desperation

A growing concern is myclobutanil, a fungicide that emits harmful hydrogen cyanide gas when burned.

“We don’t want people to reach out in desperation to materials that are pretty toxic,” Kachadoorian said.

Last month, Oregon issued a stop-sale order for the Azatrol brand of insecticides, manufactured by PBI-Gordon Corp., because it contained ingredients not approved for marijuana despite its presence on the approved-pesticides list. The mixes—advertised as “botanicals”—included EPA-restricted pyrethroid insecticides. PBI-Gordon pushed back against the action, saying Oregon’s pesticide residue limits were too low and the ingredients fell below the EPA’s threshold for toxicological significance.

Pruitt did not formally reject the requests with his letter. Instead of forcing the EPA to go through with the full denial process, the state regulators withdrew their special local need applications.

To submit an SLN request, a state must show that the product will have a “similar use pattern” to a federally registered pesticide. Housenger’s letter to Colorado offered suggestions for finding cannabis parallels in food crops and tobacco.

“We thought it was a reasonable way to deal with a potential misuse,” Housenger said.

‘Significant Economic Losses’

Late last year, General Hydroponics asked six states to apply for a SLN registration for four existing pesticides. The products range from a mixture of garlic and soybean oils with hot pepper extract, to a compound found in the seeds of the neem tree, to a bacteria-based fungicide. Although cannabis growers are technically allowed to use these ingredients, there is no information on how best to use them, or how to minimize risk to pot pickers or the environment.

“For many years cannabis and hemp have been significantly impacted by various pests such as powdery mildew, gray mold, aphids, thrips, and whiteflies,” John lnouye, a senior environmental scientist with California’s Department of Pesticide Regulation, told the Office of Pesticide Programs in his May 26 request. “These pests are causing significant economic losses and causing growers to resort to the use of unregistered pesticides.”

Under Housenger’s guidance, Inouye compared cannabis to hops and tobacco. The pesticide container labels would include language to mitigate potential harms to workers and handlers of cannabis and hemp, he said.

Less than a month later, Pruitt responded. His decision affects not only the drug, but also non-psychoactive uses of the plant, such as hemp for fiber and nutrition, and cannabidiols, compounds that do not create a high but are used to treat pain, anxiety, and epilepsy. The EPA reiterated in a statement to Bloomberg BNA that it denied requests because cannabis is “generally illegal” under federal law.

A spokewoman for Scotts Miracle-Gro said in a statement to Bloomberg BNA that “the company remains supportive of states’ conversations with federal officials about how and when to approve safe, effective control products for regulated use for the cannabis growing community.” She declined to comment further.

Longtime Marijuana Foe

The administrator’s personal response is notable. Typically, such a conclusion would not rise to the top of the EPA’s leadership, current and former regulatory officials said. In the previous administration, the issue was confined to the Office of Pesticide Programs, the division of the EPA that assesses the human and environmental safety of pesticides before they go on the market.

“It shows the level of commitment at the very highest level,” Kachadoorian of Oregon said. “It does show that they have a different philosophy toward cannabis.”

Pruitt is no friend to pot. As Oklahoma’s attorney general, he challenged the legality of Colorado’s law, arguing that the Centennial State’s export of marijuana to other states was akin to a Mexican cartel smuggling drugs across the border. Pruitt also sought unsuccessfully to rewrite an upcoming ballot measure to legalize medical marijuana in Oklahoma.

Aside from Pruitt’s track record, the EPA would have a hard time legally justifying the regulation of a prohibited product. Unless cannabis is allowed nationwide, the agency is at an impasse, said John Conner, an attorney working on pesticide issues in the Washington office of Crowell & Moring LLP.

“Until that changes, I don’t see pesticides approved through either the front door or the back door,” he said.

Opportunities for Biotech, Organic Pot

As it stands, states with cannabis programs don’t think the lack of pesticides specifically for cannabis will stifle growth in the market.

“To a certain extent this would have made things easier for the industry,” Hector Castro, a spokesman for Washington state’s Department of Agriculture, said of the SLN registrations. “But this is not shutting it down.”

“It’s a minor hindrance,” Cary Giguere, agricultural resource management section chief for the Vermont Agency of Agriculture, Food and Markets, added. “It isn’t slowing the industry down, it’s not slowing states working with the industry down.” Vermont has legalized medical marijuana, and legislators are seeking to lift the prohibition on recreational use.

But the move is putting pressure on cash-strapped states that will see their EPA grant funding dwindle in the years to come.

In the absence of a national policy, “states are left to pick up the slack,” Taylor West, deputy director of the National Cannabis Industry Association (NCIA), told Bloomberg BNA. “I think it’s fair to say that without the federal government’s resources, this process isn’t going to be as effective as it should be.”

The challenge of obtaining pesticides also could provide opportunities, Micah Tapman, managing director of Canopy, a venture capital firm with operations in San Francisco; San Diego; and Boulder, Colo., told Bloomberg BNA. It could push the industry to turn away from synthetic pesticides altogether and join the organic market, where weed can cost up to $1,600 a pound compared with the average recreational marijuana price of $1,100 a pound.

That creates its own hurdles, as the National Organic Program also operates under the auspices of the federal government. There are currently three nongovernmental organic cannabis labels.

Biotechnology is a growth area, with companies like the Lafayette, Colo.–based Front Range Biosciences’ research in advanced breeding and cloning of cannabis plants, Tapman said.

Changes Under Trump?

Ultimately, industry insiders agree there’s little wiggle room until marijuana is decriminalized nationwide. In the most likely scenario, the Department of Justice would declassify marijuana as a Schedule I drug under the Controlled Substances Act so that it’s no longer an issue of federal law, said West of NCIA. Schedule I drugs are substances that have no currently accepted medical use.

Pruitt joins Attorney General Jeff Sessions as an ardent opponent of allowing marijuana use. But the administration’s overall position on cannabis is inconclusive, West said, and President Donald Trump has supported patients’ rights to access medical marijuana.

Congress also is a mixed bag. Cannabis reform has a lot of backing within the rank-and-file in the House and Senate, according to West. But leadership has not shown the same level of support, she said.

“That makes it that much harder to predict on where there might be action on the broader issue,” said West, whose organization spent $430,000 last year lobbying lawmakers.

Ford of iAnthus is optimistic. He thinks that cannabis legalization will come in three to five years, a view he admits is different from most outlooks.

“I tend to be somewhat contrarian,” he said. “And I think that the Trump administration might surprise us.”

Link – The Cannafornian