Cannabis Industry Sees The Rare Leveraged Buyout In Curaleaf Deal

What’s so interesting about this deal? Leverage!

Multistate operator Curaleaf Holdings (CSE: CURA; OTCQB: CURLF) on Dec. 28 announced the acquisition of Bloom Dispensaries, a private, integrated Arizona cannabis operator, in a deal valued at $211 million.

Here are the basics:

- Bloom has four retail dispensaries, in Phoenix, Tucson, Peoria and Sedona, and two adjacent cultivation and processing facilities totaling approximately 63,500 square feet.

- The total consideration of $211 million will be paid using $51 million in cash and $160 million in notes, which are recourse only to the assets and equity of Bloom without any guarantee from Massachusetts-based Curaleaf.

- The notes are structured in three series, with $50 million, $50 million and $60 million due on the transaction’s first, second and third anniversaries, respectively.

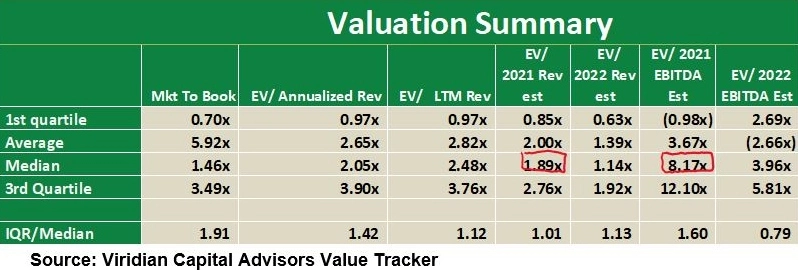

- The purchase price represents 3.2X Bloom’s estimated 2021 revenue and roughly 8.0X estimate EBITDA. (Bloom has 40%+ EBITDA margins, according to a news release.)

What’s so interesting about this deal? Leverage!

This acquisition should be viewed as a leveraged buyout (LBO), one of the first in the cannabis industry.

The $160 million debt represents roughly 6X Bloom’s EBITDA (depending on how much over 40% margins the company has), an almost-unheard-of amount of leverage on a cannabis company. Debt around 3.3X EBIDTA is more typical.

To Read The Rest Of This Article On MJ Biz Daily, Click Here