Keeping Consumers At The Center Of Your Cannabis Brand’s Strategy

Roy Bingham, Co-Founder & CEO at BDSA takes a look at consumer trends

Roy Bingham, Co-Founder & CEO, BDSA

The ever-increasing complexity of the cannabis industry demands that manufacturers, brands and retailers today understand what’s happening in the market, and the who and why behind the latest trends. By tracking cannabis consumers over time, you can begin to understand their evolution from entering the market as a first-time consumer, to being a more frequent consumer across different form factors.

Before thinking about where the market is going and where to take your brand next, you need a deep understanding of what’s happening now. According to BDSA Consumer Insights, which provides data on the demographics, psychographics and purchasing behavior of cannabis consumers across adult-use legal states, medically legal states and Canadian provinces, 73% of adults in fully legal U.S. states either consume cannabis (47%) or are open to consuming cannabis (26%). Last year, no states had 50% or more of their population consuming cannabis. Now, the Colorado, Michigan, Oregon, Nevada and Arizona markets all have at least 50% of adults claiming past six-month consumption of cannabis, revealing just how much the industry can shift in a short amount of time.

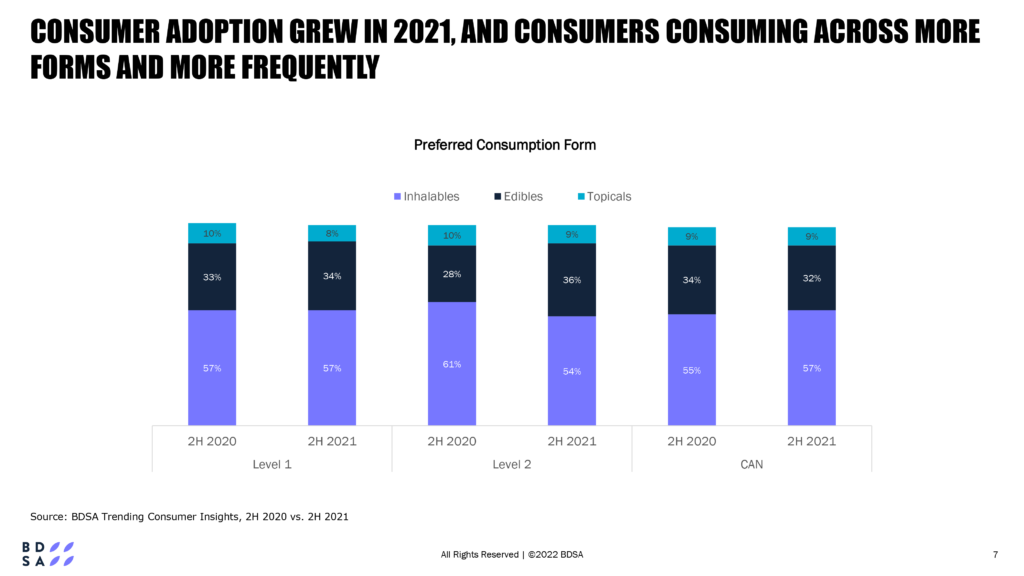

Further, it’s not just consumer penetration that needs to be considered when developing your brand’s strategy; form factor and preferred consumption method play important roles as well.

It’s essential to understand that just because a consumer prefers a single form factor, it does not mean they don’t have need states and occasions within a day or week in which they’re utilizing other form factors. In fact, it’s very common. The percentage of people consuming across form factors is growing, and people are consuming more frequently. Almost 70% of inhalable consumers in fully legal U.S.

states consume at least daily. While a huge driver of industry growth comes from new markets opening and the retail landscape expanding, topline sales are also growing due to the consumption dynamics that are developing state by state and consumer to consumer.

New State, New Strategy

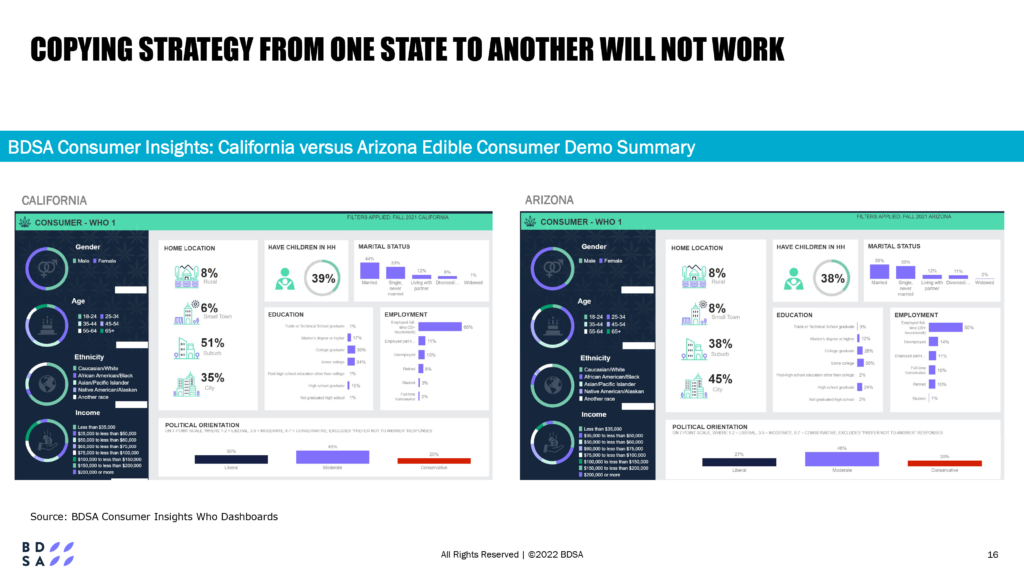

In the cannabis industry, the U.S. functions like a global market where every state has its own framework, regulations, consumer population and behaviors. Therefore, copying the strategy used in one state in another simply will not work. When planning to enter a new market, you should first assess why the brand is strong in the existing market before predicting or planning for future performance.

Next, consider the total addressable market for a particular product within the new market. What does that market look like, how is this product trending and what percentage of that share could your brand potentially capture? From there, diving deeper into the market’s consumers and their behaviors is critical. Who’s consuming? What are they consuming? Why are they consuming? What trends and pricing dynamics are happening in the new market? By answering these questions, you can determine the best way to enter the new market, know which products to enter with and identify which consumers to target.

Give the People What They Want

Suppose a California edibles brand is looking to move into Arizona. In that case, they might anchor their consumer target strategy with form factors and ask questions like, ‘Who are edibles consumers in Arizona, and how do they differ from California edibles consumers?’ It’s crucial to understand those differences and adjust your brand strategy accordingly. Assess the current product and brand landscape for cannabis edibles in Arizona, analyze the five-year forecast and determine if the consumer population is growing, and if interest in this form factor is also increasing. That will reveal the strength of the market, and the larger opportunity over time.

While demographics help us think about targeting, communicating, cross-selling and upselling, it’s important to keep in mind that it’s not only demographics that drive how people consume or behave—you also need to know what your target consumer wants. Why are they buying what they’re buying, and what attributes within the edibles category matter to them—is it THC content, price, or something

else?

When looking at the gendered split between Arizona edible consumers versus California, edible consumers in Arizona tend to skew more female than male, while in California, it’s closer to a 50/50 split. This is important to consider when developing a brand strategy to enter a new market. If the consumer looks different, it might suggest you need to adjust retailer or budtender training. You may need to adjust your strategy on what stores to prioritize getting distribution in, and it might mean you need to consider your product lineup and which SKUs to prioritize in the new market.

Delve into the Details

Go further, still, by focusing on the details. It’s not enough to know that the top reasons consumers choose edibles are to sleep better, to relieve pain and to relax. It’s also important to think about the frequency of consumption. The more frequent the consumption, the more frequent the shopper, meaning the more they spend on your brand. The next layer is to really dissect that edible consumer profile and

answer questions like:

- What do they look like?

- How do they think?

- How do they behave differently than the average edible consumer?

The answers to these questions are key ways to differentiate your product and your product strategy. Things like the familiarity of a brand, familiarity of a strain and a credible recommendation from a friend, family member or budtender matter to people. As you think about entering new markets, how do you ensure that your brand offers and provides the information, education, and recommendations that consumers are looking for right now?

Having access to comprehensive data is crucial to building a successful brand strategy. It’s the only way to answer all the important questions before entering a new market. Data and consumer insights identify who your target consumers are demographically, psychographically and behaviorally. Do they consume wine? Do they enjoy spending time with their family? Do they like to try new things? All of these factors matter in terms of really unpacking who consumers are and why they’re behaving in the ways that they are. To enter a market with the strongest position possible, know who these people are, understand why they’re consuming, what they’re consuming, and what’s that need state or occasion of consumption.

To learn more about the BDSA, Click Here